What is the GE-McKinsey Matrix?

Resource scarcity is a fact of life. While you may have many things to do, the resources available to execute them will often be limiting. This makes it necessary to be methodical with the allocation of whatever resources you have.

The GE-McKinsey Matrix is one of many frameworks that businesses can use to ensure the effective use of limited available resources. It offers immense help in evaluating a product or business portfolio to enable you to prioritize investments among them effectively.

About the Framework

The GE-McKinsey Matrix is a strategic portfolio analysis tool that is designed for use in corporate strategy. It is one of the earliest frameworks that emerged to help multi-business corporations tackle the challenge of managing multiple business units profitably. According to McKinsey, it provides a “systematic approach for the decentralized corporation to determine where best to invest its cash.”

You might wonder how the name of the framework, which is also called the nine-box matrix or GE Matrix, came about. It was developed by global management consulting firm McKinsey & Company after it was approached in the 1970s by General Electric for help with managing its large business portfolio.

The GE-McKinsey Matrix is regarded as a precursor to multiple product models, which include MACS. Many large corporations today use the framework, or a variant of it, for modeling and analyzing their businesses.

GE-McKinsey Matrix Explained

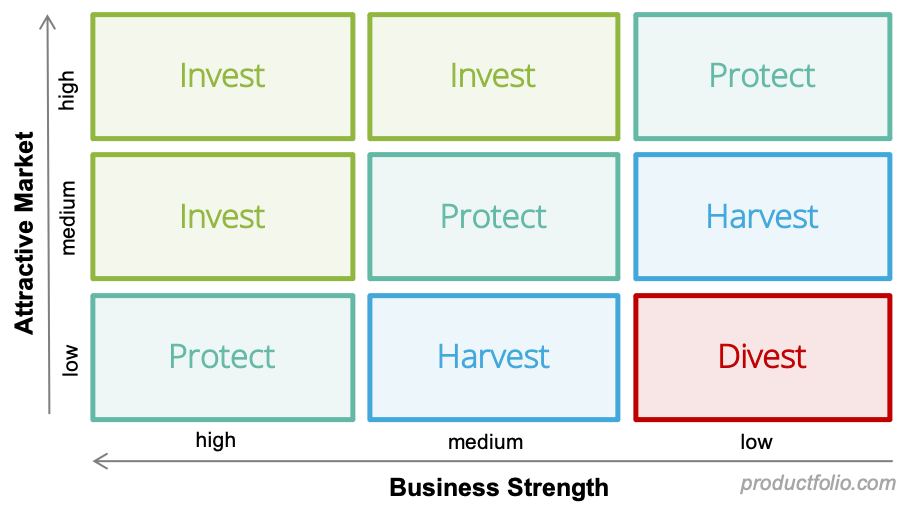

This framework proposes the analysis of product lines or business units based on two criteria: industry attractiveness and business or competitive strength. These factors are used to create a 3×3 matrix, with industry attractiveness on Y-axis and competitive strength on the X-axis.

Business units or products in a portfolio are arranged into nine cells in the matrix and evaluated based on the two axes or factors. Both industry attractiveness and competitive strength are commonly divided into high, medium, and low. The arrangement of units in the matrix makes managing them easier.

Industry attractiveness

This axis considers the attractiveness of the industry in focus. What benefits does it offer the company if it decides to play in it? How easy or hard would the company find operating profitably in that industry? The higher the potential for profits, the more attractive an industry becomes.

Common factors that determine the attractiveness of an industry, or otherwise, include:

- Market size

- Industry structure

- Competition

- Product life cycle

- Long-run growth rate

- Demand variability

- Market segmentation

- Macro environment factors

Competitive strength

This has to do with the ability of a product or business unit to compete effectively in the market. How well can it hold up against the competition? What edge does it have over rivals? Managers essentially try here to determine what competitive advantage exists, how to sustain it, and for how long it can be sustained.

Both internal and external factors are involved when evaluating competitive strength. The most common ones include:

- Total market share

- Growth in market share (relative to rivals)

- Profitability

- Customer loyalty

- Level of product differentiation

- Brand equity

- Production flexibility

GE-McKinsey Matrix vs. BCG Matrix

The nine-box framework shares some similarities with the Boston Consulting Group’s growth-share matrix (more popularly called the BCG Matrix). The model came on the heels of the latter and is often considered an improvement on it.

Both of these frameworks are used for analyzing portfolios to guide investment decisions. However, they are different in terms of the factors they take into consideration. BCG’s framework is a 2×2 model that is too simplistic for many large companies for their analyses. It takes only one measure or factor (market share) into consideration.

McKinsey’s version offers something more robust and compelling with minimal confusion. It is a multi-variable framework that takes into account more than one factor, making for a more comprehensive analysis.

GE-McKinsey Matrix Strategies

This framework gives rise to three categories with strategic implications. You carry out your analysis of products or business units by sorting them into these categories to determine the most appropriate strategies.

Invest/Grow

You should consider pursuing investment and growth strategies for business units or product lines arranged in boxes around the top-left corner of the matrix (above the diagonal). These units promise the highest returns at some point. Investments in R & D, advertising, and promotions are needed to enhance the attainment of those potentials.

Selectivity/Earnings

This relates to units arranged in the diagonal. You should only think of investing in them if you have resources left after investments in the Invest/Grow group. The units in the boxes come with a high level of uncertainty which is why they come last when thinking of investing. Even if there are excess resources, the expected outlook determines whether to invest here at all.

Harvest/Divest

This is the category for the business units below the diagonal. The best strategies for these include sale and liquidation. These units are in an industry that is not attractive (profitable) or they lack competitive strength or even fall short on both considerations. They are somewhat comparable to the “Dogs” in the BCG Matrix.